Please update your browser.

2019冠状病毒病大流行导致前所未有的经济衰退,影响了家庭的财务状况. 澳博官方网站app研究所利用去识别的行政银行数据,结合家庭收入和支出来评估支票账户余额. Based on recent JPMC Institute research, 这份《澳博官方网站app》分析了2019冠状病毒病大流行期间现金余额的变化以及现金余额分布和收入四分位数的持续复苏.

During the pandemic, 联邦政府通过刺激支付直接向家庭提供现金援助, unemployment insurance, and most recently, the Advanced Child Tax Credit (CTC). The first round of stimulus, or economic impact payments (EIP), started April 15, 2020 and delivered up to $1,200 per adult and $500 per qualifying child. A second round of EIP was distributed in January 2021, 为每位符合条件的成人或儿童提供高达600美元的补贴。第三轮刺激计划于3月17日开始发放, 2021, providing $1,400 per eligible adult or child. Throughout this time, expanded unemployment insurance delivered payments to jobless workers, including gig workers and self-employed workers, with a $600 weekly supplement between March and July 2020, and a $300 weekly supplement during October of 2020 and since January 2021. 2021年6月和7月,26个州分阶段扩大了资格和支付补贴. On July 15, 2021, the first monthly Advanced Child Tax Credit payments were delivered, 每名6岁以下儿童最高可获资助300元,每名6至17岁儿童最高可获资助250元.

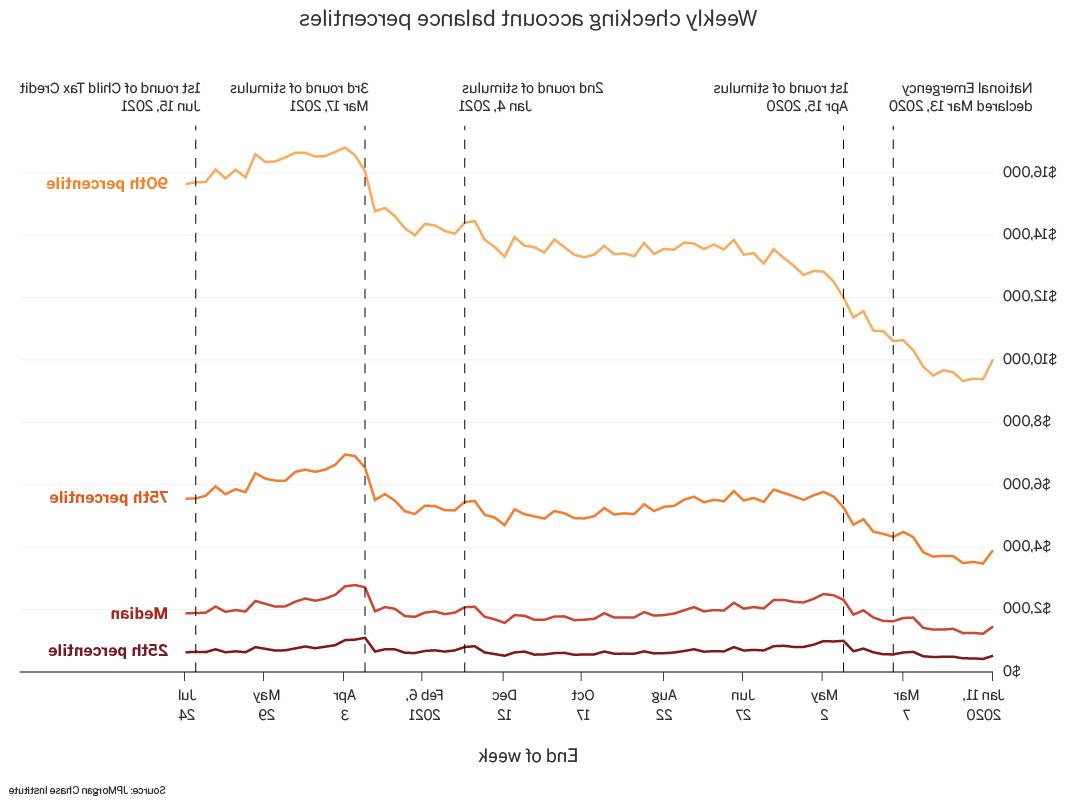

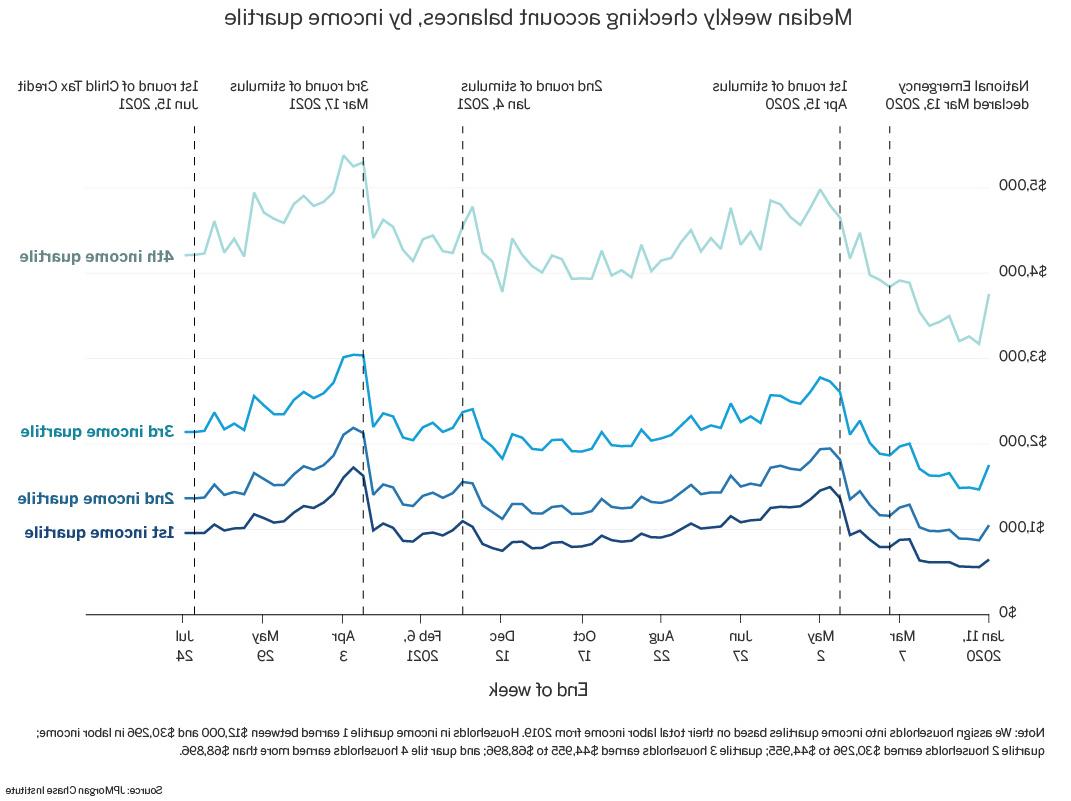

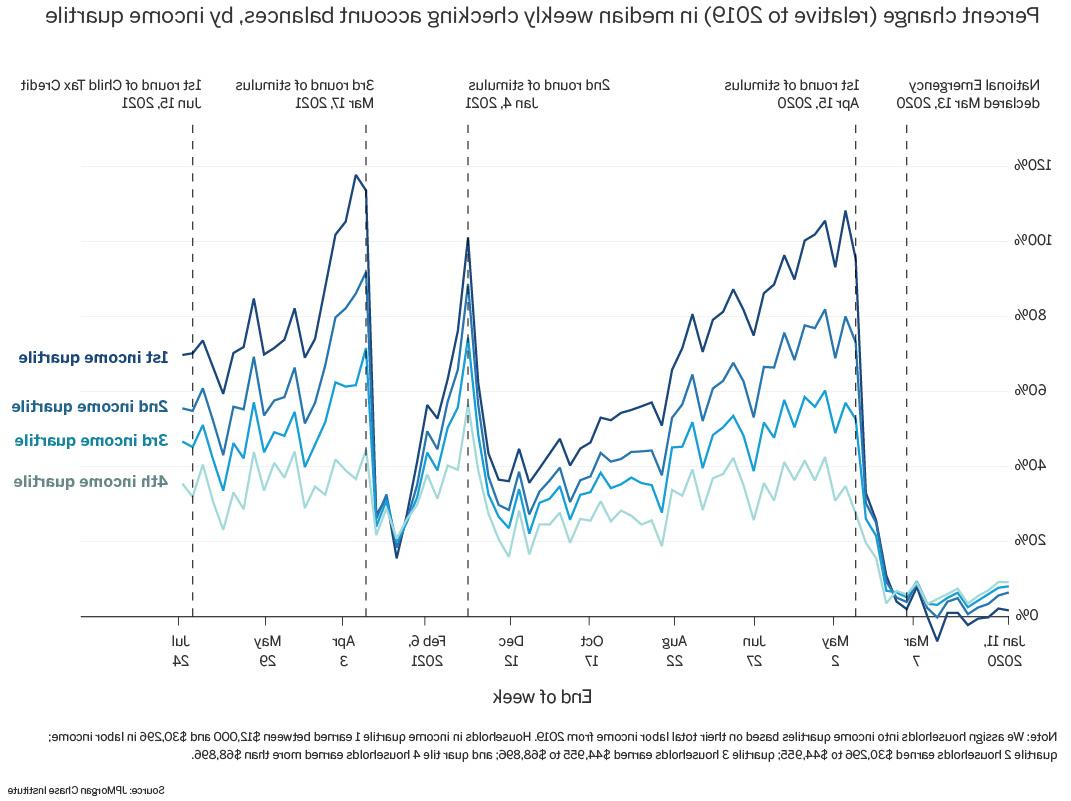

截至2021年7月底,现金余额中位数比2019年同期高出50%以上. As shown in Figures 1 and 2, we observe a greater percent increase in the 90th percentile of balances, suggesting continued growth, particularly at the top end of the liquid asset distribution. In addition, 图3和图4显示,低收入家庭(收入四分位数1)的余额比2019年的水平高出约70%, 而高收入家庭(收入四分之一)的余额比2019年的水平高出约35%.

Following each round of stimulus, 在刺激计划实施后的几周内,流动资产分布的低端和低收入家庭的余额出现了较大比例的增长,但这些余额的消耗速度也更快, showing the importance of targeted support. 从图1和图3可以看出,第三轮刺激的规模要比第二轮刺激大得多, and delivered at a time when cash balances were already high. Possibly as a result, 第三轮的平衡收益似乎比第二轮消耗得更慢(图2和图4)。.

Given its smaller size and reach compared to stimulus payments, 高级儿童税收抵免(Advanced Child Tax Credits)并没有像每一轮刺激计划那样带来大量现金增长. That said, 提前CTC是一种按月支付的方式,它可能会减缓第三轮刺激计划带来的平衡收益的消耗, thus supporting family cash buffers during the COVID pandemic. 与上文讨论的其他形式的政府现金援助相比,先进儿童税收抵免支付的总规模较小. According to Treasury statements, the Federal Government disbursed $12.7 billion in Advanced Child Tax Credits in July 2021 compared to $28.3 billion in Unemployment Benefits in the same month (and $39.1 billion in June 2021), and more than $400 billion in the third round of Economic Impact Payments. Put differently, 高级CTC约为7月联邦失业保险支出的一半,仅为第三轮刺激计划规模的3%.

这些总额之所以较小,部分原因是领取补贴的家庭比例较小——大约有3500万个有孩子的家庭, or 27 percent of the total 128 million households in the U.S., received the payments. In contrast, roughly 85 percent of adults received a stimulus check. In addition, 每个家庭的支付规模比三轮刺激计划中的任何一轮都要小. Importantly, 导致提前CTC付款的到来,家庭的现金余额正在下降. Thus, 先进的CTC可能有助于减缓第三轮刺激计划后现金余额的支出.

Figure 1: Cash balances increased with the arrival of each round of stimulus, and remain elevated relative to pre-pandemic levels

Figure 2: Cash balances increased with the arrival of each round of stimulus, with larger percent increases at the low end of the distribution

Figure 3: For families at all income levels, cash balances increased with the arrival of each round of stimulus, and remain elevated relative to pre-pandemic levels

Figure 4: With each round of stimulus, low-income families saw the greatest percent gains in cash balances, but depleted those gains faster than high-income families

我们感谢内部合作伙伴的支持,尤其是安东尼·里维拉. We are indebted to our internal partners and colleagues, who support delivery of our agenda in a myriad of ways, and acknowledge their contributions to each and all releases.

We would like to acknowledge Jamie Dimon, CEO of JPMorgan Chase & Co., 表彰他在建立研究所和推动正在进行的研究议程方面的远见卓识和领导能力. We remain deeply grateful to Peter Scher, Vice Chairman, Demetrios Marantis, Head of Corporate Responsibility, Heather Higginbottom, Head of Research & Policy, 以及公司其他员工的资源和支持,以开创一种新的方法,为全球经济分析和洞察力做出贡献.

本材料是澳博官方网站app研究所的产品,仅供提供一般信息之用. Unless otherwise specifically stated, 此处表达的任何观点或意见仅为所列作者的观点或意见,可能与J .表达的观点和意见不同.P. 摩根证券有限责任公司(JPMS)研究部或澳博官方网站app的其他部门或部门 & Co. or its affiliates. This material is not a product of the Research Department of JPMS. 消息来源被认为是可靠的,但澳博官方网站app & Co. or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy. 截至本材料发布之日,意见和估计构成我们的判断,并可随时更改,恕不另行通知. 本报告所依赖的数据是基于过去的交易,可能不代表未来的结果. 此处的意见不应被解释为对任何特定客户的个人推荐,也不打算作为对特定证券的推荐, financial instruments, or strategies for a particular client. 本材料不构成招揽或要约在任何司法管辖区,这种招揽是非法的.